Overcoming Systemic Denial of Credit Access

Introduction

The United States is often heralded as the land of opportunity and economic prosperity. It’s a nation built on principles of hard work, innovation, and entrepreneurial spirit. Yet, beneath the facade of economic affluence lies a complex reality. The U.S. economy is fundamentally a debt-based economy. This reliance on debt, encompassing personal, corporate, and government borrowing, has driven economic growth and stability for decades.

However, the systemic denial of access to loans and credit for Black Americans, has created economic distress and poverty akin to the effects of economic sanctions. In this article, we will explore mechanisms of the debt-based economy and the profound implications of credit discrimination that creates racial economic disparities.

Debt serves as an economic engine, but its benefits have not been equally distributed. Black Americans have historically faced substantial barriers to accessing loans and credit, amounting to centuries of disparities.

The Debt-Based Economy – A Fundamental Pillar

The U.S. economy thrives on credit and debt, and it’s evident at all levels:

- Personal Debt: For many Americans, credit cards, student loans, and mortgages are essential components of their financial lives. These forms of debt enable individuals to afford education, homes, and consumer goods.

- Corporate Debt: Companies routinely leverage debt to fund expansions, research and development, and daily operations. Corporate bonds and loans are vital sources of capital for businesses across various sectors.

- Government Debt: The federal government relies on debt issuance through Treasury bonds and bills to fund its activities, including public programs, infrastructure projects, and budget deficits. The national debt, which combines all these obligations, is a reflection of the country’s borrowing.

Systemic Denial of Credit Access for Black Americans

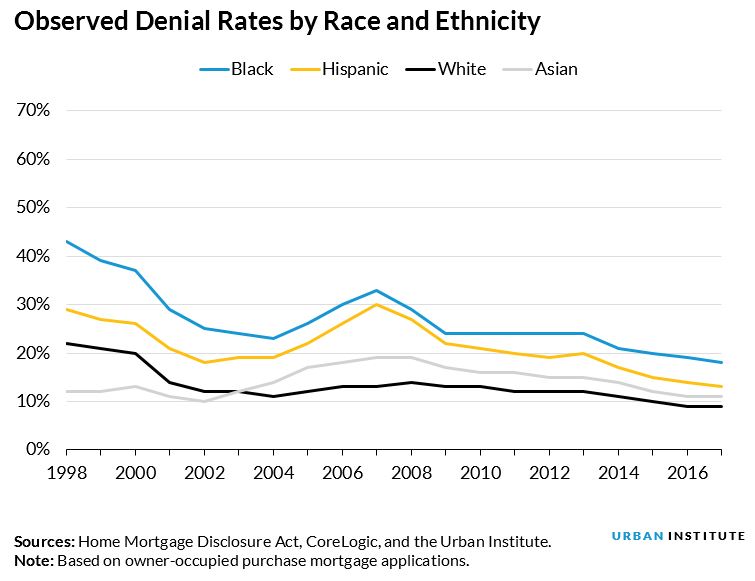

While debt serves as an economic engine, its benefits have not been equally distributed. Black Americans have historically faced substantial barriers to accessing loans and credit, amounting to centuries of lending discrimination.

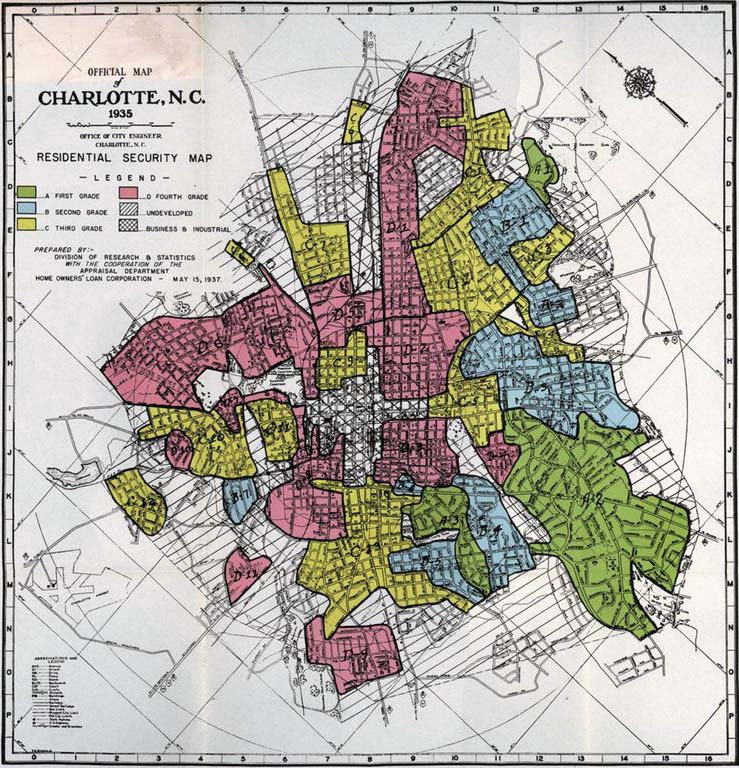

- Historical Context: The roots of credit discrimination against Black Americans can be traced back to slavery, Jim Crow segregation, and ongoing racial bias. Redlining, a practice that systematically excluded Black communities from mortgage lending and homeownership opportunities, is a stark example.

- The Wealth Gap: The denial of access to loans and mortgages has resulted in a profound wealth gap between Black and white Americans. Homeownership, a cornerstone of wealth accumulation, has been significantly hampered in Black communities.

- Limited Entrepreneurship Opportunities: Black entrepreneurs often struggle to secure business loans, restricting their ability to initiate and expand businesses. This lack of credit access hampers economic growth and job creation in Black communities.

- Education and Employment: Limited access to quality education and employment opportunities can force Black individuals to rely on high-interest payday loans and credit card debt, perpetuating a cycle of financial instability.

- Investment in Communities: Without access to loans for housing and business development, Black communities often struggle to attract investment, leading to deteriorating infrastructure and limited economic prospects.

Conclusion

The United States’ debt-based economy has been a driving force behind its economic growth and prosperity, allowing individuals, businesses, and the government to finance their activities and investments. However, the systemic denial of access to loans and credit for Black Americans has created severe economic distress and poverty, similar in its consequences to economic sanctions. This historic injustice perpetuates a cycle of inequality, hampers economic progress, and underscores the urgent need for systemic changes in lending practices, financial education, and social policies to address and rectify these disparities. Achieving a more equitable financial system is not just a moral imperative but also a path toward a stronger, more inclusive U.S. economy.

English

English