Fighting Racism in Real Estate and Lending

Introduction

The history of racism and systemic inequality in real estate and mortgage lending in the United States is a painful and enduring legacy. Discriminatory practices have disadvantaged Black Americans, denying them equal access to homeownership and economic opportunities. This article will shed light on how housing and mortgage policies have harmed Black communities, and stifled overall economic growth.

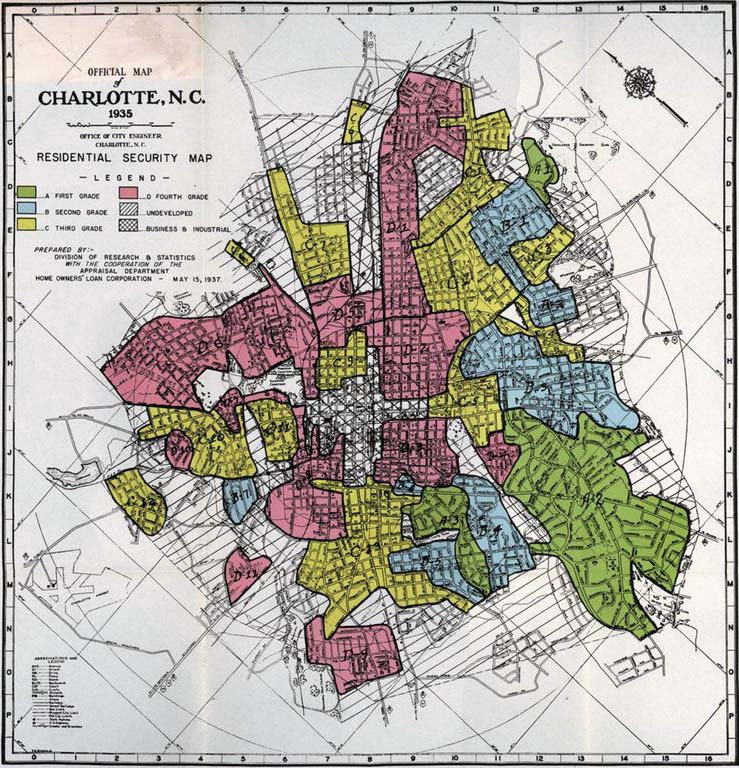

Redlining

One of the most notorious examples of housing discrimination is redlining, a practice that began in the 1930s. The federal government, through agencies like the Home Owners’ Loan Corporation (HOLC), classified neighborhoods into risk categories based on racial composition. Areas with predominantly Black residents were marked as high-risk and given the color red on maps, hence the term “redlining.”

Effects of Redlining

- Limited Access to Mortgages: Redlining effectively denied Black Americans access to federally insured mortgages, making it nearly impossible for them to buy homes. White families, on the other hand, received government-backed loans, facilitating homeownership and wealth accumulation.

- Decreased Property Values: The devaluation of Black neighborhoods by the government led to lower property values, making it harder for residents to build equity through homeownership.

- Cycle of Poverty: Denied the opportunity to invest in homes and communities, Black families were forced to rent, perpetuating a cycle of poverty and instability.

The harm inflicted on Black Americans by discriminatory housing and mortgage policies has consequences for the entire nation.

Government Programs That Excluded Black Americans

- The GI Bill: After World War II, the GI Bill provided returning veterans with access to education and homeownership opportunities. However, Black veterans faced significant discrimination in receiving these benefits, leading to stark disparities in homeownership rates and education.

- Federal Housing Administration (FHA) Policies: FHA policies explicitly discouraged lending to Black Americans and promoted racial segregation. These practices not only excluded Black families from homeownership but also reinforced the segregation of neighborhoods.

The Ongoing Consequences

- Wealth Gap: The denial of homeownership opportunities through discriminatory lending practices has resulted in a staggering wealth gap between Black and white Americans. Homeownership is a primary source of wealth accumulation, and this disparity continues to widen.

- Limited Economic Mobility: Without access to homeownership, Black Americans often miss out on the financial benefits of property appreciation and the ability to pass down wealth to future generations, hindering upward economic mobility.

- Neighborhood Disinvestment: Discriminatory lending practices have led to disinvestment in Black neighborhoods, including inferior schools, limited access to healthcare, and reduced public services. These factors contribute to persistent socioeconomic disparities.

Stifled National Growth

The harm inflicted on Black Americans by discriminatory housing and mortgage policies has consequences for the entire nation

- Economic Drag: The wealth and income disparities created by these practices result in less economic activity and reduced consumer spending, ultimately hindering overall economic growth.

- Talent Pool Constraints: Discrimination in housing contributes to geographic disparities in education and employment opportunities, limiting the potential contributions of talented individuals and stifling national innovation.

Conclusion

The legacy of racism in real estate and mortgage lending continues to haunt Black Americans, perpetuating a cycle of poverty and inequality. Discriminatory policies, often endorsed or facilitated by government programs, have denied Black families the opportunity to build wealth through homeownership. The harms inflicted on Black communities reverberates across the entire nation, contributing to economic disparities and stifling growth.

Addressing these disparities requires not only acknowledging the historical injustices but also implementing policies that promote equitable access to credit. It is not only a moral imperative but also an economic one, as a more inclusive and equitable society is one that can truly harness the full potential of all its citizens and ensure sustained national growth.

Redlining and economic exclusion for Black Americans are a past and current obstacle to creating wealth. This CBS News Special highlights the racial disparities and economic harm caused to Black Americans.

English

English