Bridging the Ownership Gap with Tokenized Real Estate

Introduction

The real estate market is experiencing a transformative shift with the emergence of tokenization, a process that converts real estate assets into digital tokens stored on a blockchain. This innovative approach, also known as fractional real estate ownership or tokenized real estate, has the potential to address the ownership gap for Black Americans and revolutionize the home appraisal market, ending disparities in undervalued home prices caused by institutional racism. With real estate tokens accounting for nearly 40% of the digital securities market and a market size of around $200 million, tokenized real estate is gaining popularity as an investment option.

How Tokenized Real Estate Works

Tokenization involves breaking down expensive properties into smaller, more affordable units represented by digital tokens. These tokens are stored on a secure and transparent blockchain, enabling digital ownership and transfer of fractional shares. The process utilizes smart contracts, which automatically execute transfers when specific conditions are met. This combination of blockchain and smart contracts streamlines transactions, reduces the need for intermediaries, and improves efficiency.

They must identify every person that has a common need, a common interest and a common dilemma and come together and build communities. If they can’t build communities, they must build a sense of community. In that sense of community they begin to practice group economics and group politics. That’s what Powernomics is about.

Dr. Claud Anderson

Benefits for Black Americans

Tokenized real estate offers several benefits for Black Americans, helping to bridge the ownership gap and address historical disparities in the real estate market. Here are some key advantages:

- Increased Access to Property Ownership. Tokenized real estate allows Black Americans, particularly those with limited financial resources, to participate in property ownership. By offering fractional ownership, individuals can invest in high-value properties by purchasing smaller shares. This lowers the barrier to entry and provides an opportunity to accumulate wealth through real estate investments that were previously inaccessible.

- Wealth Accumulation and Diversification. Historically, real estate ownership has been a significant source of wealth creation. Tokenized real estate provides Black Americans with a pathway to build and diversify their wealth portfolios. By investing in fractional shares of different properties, they can benefit from potential appreciation and income generation that come with real estate investments.

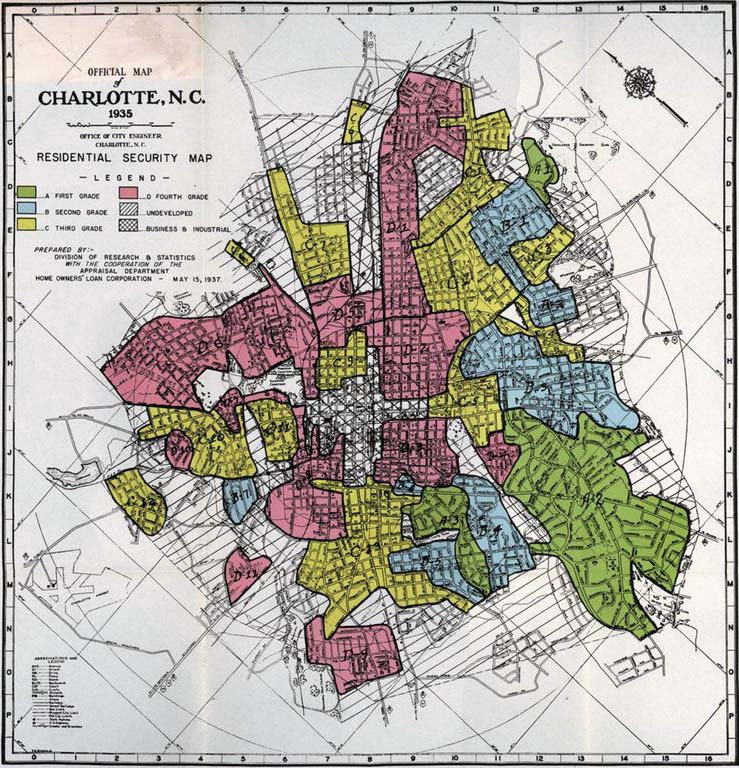

- Mitigating Historical Disparities. Institutional racism has led to undervalued home prices for Black Americans, perpetuating wealth disparities. Tokenized real estate can help address this issue by introducing a more transparent and objective valuation system. Blockchain technology and decentralized ownership records ensure that property values are determined based on market factors, reducing the influence of subjective biases and leveling the playing field.

- Enhanced Market Transparency. Tokenization brings greater transparency to the real estate market. Blockchain technology ensures that ownership records, transaction history, and property information are securely stored and easily accessible. This transparency reduces the information asymmetry that can disadvantage minority communities and provides Black Americans with more reliable and verifiable data for making informed investment decisions.

- Liquidity and Flexibility. Tokenized real estate enhances liquidity by enabling easier and faster transfer of fractional ownership. Traditional real estate investments often suffer from illiquidity, making it challenging to access funds when needed. With tokenization, Black Americans can sell their fractional shares more readily, providing them with greater flexibility and financial agility.

- Wealth Creation and Investment Opportunities. Tokenized real estate opens up investment opportunities for Black Americans, allowing them to diversify their portfolios and potentially generate wealth. By investing in fractional shares of properties, individuals can benefit from real estate’s potential high returns, which were previously out of reach for many due to financial barriers.

- Empowerment and Economic Growth. Tokenized real estate empowers Black Americans by granting them a stake in valuable properties. This sense of ownership and investment in their communities can contribute to economic growth and revitalization, fostering a sense of pride and encouraging further investment in marginalized areas.

Conclusion

Tokenized real estate offers immense potential for bridging the ownership gap for Black Americans and creating a fairer home appraisal market. By enabling fractional ownership, increasing transparency, and providing investment opportunities, tokenized real estate empowers marginalized communities to accumulate wealth and participate in the real estate market. As the industry matures and regulatory frameworks evolve, the full potential of tokenized real estate will become increasingly evident, shaping the future of real estate investments and leveling the playing field for Black Americans.

English

English